Earlier last week, people familiar with the matter said that the European Union is coordinating with the Group of Seven (G7) to discuss setting the price ceiling of Russian crude oil at between US$65 and US$70 per barrel. Affected by this, WTI crude oil fell from a short-term high of $90 to below $80. However, in subsequent meetings, the EU failed to reach an agreement on the price limit for Russian oil, and there were “too large differences” among member states. It is expected that the decline in crude oil prices will slow down in the future. At the same time, domestic coal prices continue to fall, and the recent decline of coal in producing areas is generally more than 10%, and the pessimistic expectations will continue in the near future.

Affected by this, recently In a week, the cost support ability of various domestic polyurethane products is weak, and the market price is barely stable, which is a good situation. From the perspective of the demand side, at present, the downstream purchasing enthusiasm of polyurethane is still insufficient, the market offer is flat, and the market expectation continues to be sluggish.

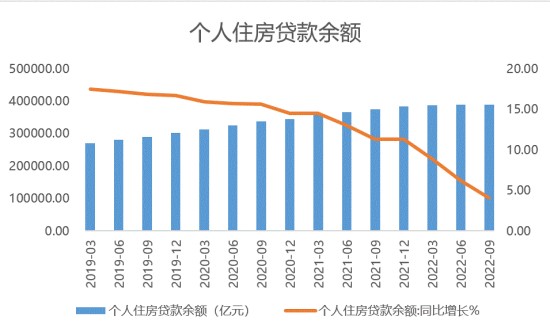

From a macro perspective, The European Central Bank’s October monetary policy minutes show that the current monetary tightening policy in Europe will continue, and interest rates will be further raised in the future. Members generally agreed that monetary policy should continue to rely on data, rather than following a preset path by setting interest rates meeting by meeting. The current level of inflation in Europe is still higher than that before the Russo-Ukraine war. The United States has already shown a weakening trend in the margin of interest rate hikes, and the Federal Reserve’s hawkish metamorphosis has shown signs of easing. In November, the Markit manufacturing PMI index fell below 50, recording 47.6%, and the service industry PMI index also fell to 46.1% more than expected. . On the domestic front, the National Standing Committee this week continued to promote the implementation of measures to stabilize growth, and decided to send a supervisory working group to the local area to urge the implementation of policies and measures that had been introduced in the previous period, and pointed out that “timely and appropriate use of monetary policy tools such as RRR cuts”; The China Insurance Regulatory Commission issued the “Notice on Doing a Good Job of Financial Support for the Steady and Healthy Development of the Real Estate Market”, which aims to protect the reasonableness and moderation of real estate financing and promote the stable and healthy development of the real estate market.

The latest January-October industrial enterprise profit data has been released. From January to October, the decline in the profits of industrial enterprises continued to expand. From the industry point of view, the growth rate of the upstream mining industry has slowed down, such as coal mining +62% (+88.8%) year-on-year, and oil mining +109.7% (+112%) year-on-year. The profits of the midstream equipment manufacturing industry improved significantly. Among them, the profit of general equipment was -4.4% (-7.2%) year-on-year, and the profit of special equipment was +0.3% (-1.3%) year-on-year. The accumulative year-on-year turnaround of the automobile manufacturing industry is related to the rapid growth of automobile sales. The accumulative growth rate of public utility profits was +15.5% (+4.9%) year-on-year, a sharp rebound from the previous value.

At present, the intensity of domestic steady growth determines the biggest marginal change in the polyurethane industry. The market unanimously expects that the reserve ratio will be lowered in the near future. At the same time, the timely implementation of the real estate rescue policy will play an important role in supporting the demand of the polyurethane industry. If real estate, the biggest obstacle affecting the demand of the polyurethane industry this year, can stabilize, it is expected to bring about significant improvements.

In addition, the domestic epidemic zero policy has shown signs of loosening. It is expected that the liberalization of epidemic prevention will be a slow process with twists and turns, but compared with next year, this year should be the most influential situation. The expected period of the weakest demand for polyurethane is likely to pass soon.

微信扫一扫打赏

微信扫一扫打赏