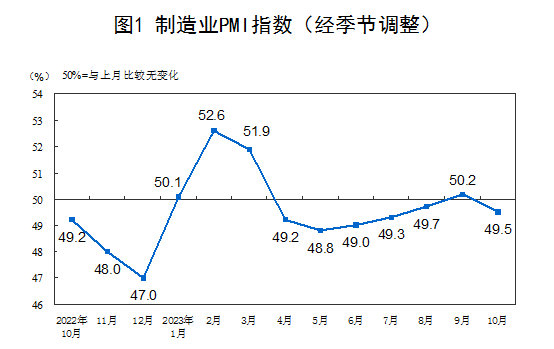

1. Operation of China’s Manufacturing Purchasing Managers Index

In October, the manufacturing purchasing managers index (PMI) was 49.5%, down 0.7 percentage points from the previous month, falling to the contraction range, and the prosperity level of the manufacturing industry has declined.

In terms of enterprise size, the PMI of large enterprises was 50.7%, down 0.9 percentage points from the previous month, and continued to be higher than the critical point; the PMIs of medium and small enterprises were 48.7% and 47.9% respectively, down 0.9 and 0.1 percentage points from the previous month. percentage points, below the critical point.

From the perspective of sub-indices, among the five sub-indices that make up the manufacturing PMI, the production index and supplier delivery time index are higher than the critical point, while the new order index, raw material inventory index and employee index are lower than the critical point.

The production index was 50.9%, down 1.8 percentage points from the previous month and still higher than the critical point, indicating that manufacturing production is still expanding, but at a slower pace.

The new orders index was 49.5%, down 1.0 percentage points from the previous month, indicating that manufacturing market demand has declined.

The raw material inventory index was 48.2%, down 0.3 percentage points from the previous month, indicating that the inventory of major raw materials in the manufacturing industry continued to decrease.

The employment index was 48.0%, a decrease of 0.1 percentage points from the previous month, indicating that the employment prosperity of manufacturing enterprises has declined slightly.

The supplier delivery time index was 50.2%, down 0.6 percentage points from the previous month and still higher than the critical point, indicating that the delivery time of manufacturing raw material suppliers continues to accelerate.

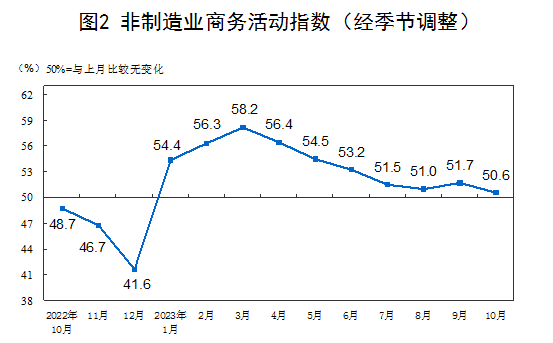

2. Operation status of China’s non-manufacturing purchasing managers’ index

In October, the non-manufacturing business activity index was 50.6%, down 1.1 percentage points from the previous month and still higher than the critical point. The non-manufacturing industry generally maintained expansion.

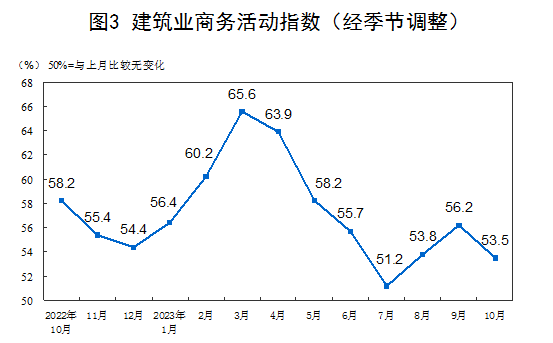

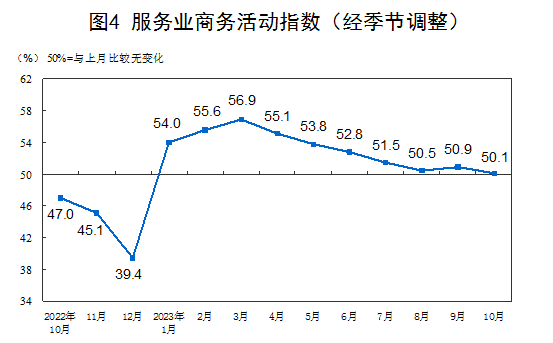

Looking at different industries, the business activity index of the construction industry was 53.5%, a decrease of 2.7 percentage points from the previous month; the business activity index of the service industry was 50.1%, a decrease of 0.8 percentage points from the previous month. From an industry perspective, the business activity index of industries such as railway transportation, air transportation, postal service, telecommunications, radio and television, and satellite transmission services is in the high-prosperity range above 60.0%; the business activity index of industries such as capital market services and real estate is below the critical point.

The new orders index was 46.7%, down 1.1 percentage points from the previous month, indicating that non-manufacturing market demand has declined. In terms of industries, the new orders index of the construction industry was 49.2%, a decrease of 0.8 percentage points from the previous month; the new orders index of the service industry was 46.2%, a decrease of 1.2 percentage points from the previous month.

The input price index was 49.7%, down 2.8 percentage points from the previous month, indicating that the overall level of input prices used by non-manufacturing enterprises for business activities was slightly lower than last month. In terms of industries, the input price index of the construction industry was 49.9%, a decrease of 4.8 percentage points from the previous month; the input price index of the service industry was 49.7%, a decrease of 2.4 percentage points from the previous month.

The sales price index was 48.6%, down 1.7 percentage points from the previous month, indicating that the overall level of non-manufacturing sales prices dropped. In terms of industries, the sales price index of the construction industry was 50.0%, a decrease of 1.5 percentage points from the previous month; the sales price index of the service industry was 48.3%, a decrease of 1.7 percentage points from the previous month.

The employment index was 46.5%, a decrease of 0.3 percentage points from the previous month, indicating that the employment prosperity of non-manufacturing enterprises has declined. In terms of industries, the employee index in the construction industry was 46.4%, an increase of 0.1 percentage points from the previous month; the employee index in the service industry was 46.5%, a decrease of 0.4 percentage points from the previous month.

The business activity expectation index was 58.1%, down 0.6 percentage points from the previous month and still in a relatively high business range, indicating that non-manufacturing companies remain optimistic about the recent market recovery and development. Looking at different industries, the construction industry business activity expectation index was 61.4%, down 0.4 percentage points from the previous month; the service industry business activity expectation index was 57.5%, down 0.6 percentage points from the previous month.

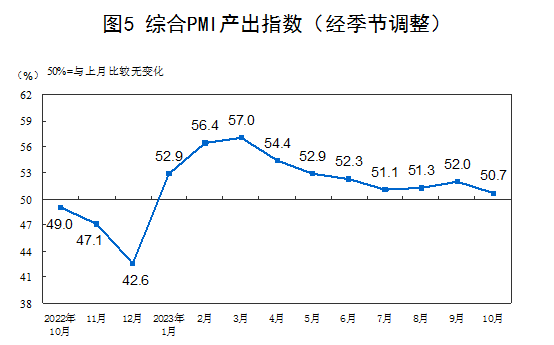

3. Operation of China’s Comprehensive PMI Output Index

In October, the comprehensive PMI output index was 50.7%, a decrease of 1.3 percentage points from the previous month, indicating that the production and operation activities of my country’s enterprises are generally expanding, but the expansion rate is slowing down.

微信扫一扫打赏

微信扫一扫打赏